Condo Insurance in and around Roscoe

Unlock great condo insurance in Roscoe

Quality coverage for your condo and belongings inside

Your Possessions Need Protection—and So Does Your Condo.

There is much to consider, like coverage options providers, and more, when looking for the right condo insurance. With State Farm, this doesn't have to be a difficult decision. Not only is the coverage remarkable, but it is also well priced. And that's not all! The coverage can help provide protection for your condo unit and also your personal property inside, including things like bedroom sets, furniture and furnishings.

Unlock great condo insurance in Roscoe

Quality coverage for your condo and belongings inside

Condo Unitowners Insurance You Can Count On

Condo unitowners coverage like this is what sets State Farm apart from the rest. Agent Erik Abrahamsen can be there whenever the unexpected happens to help you submit your claim. State Farm is there for you.

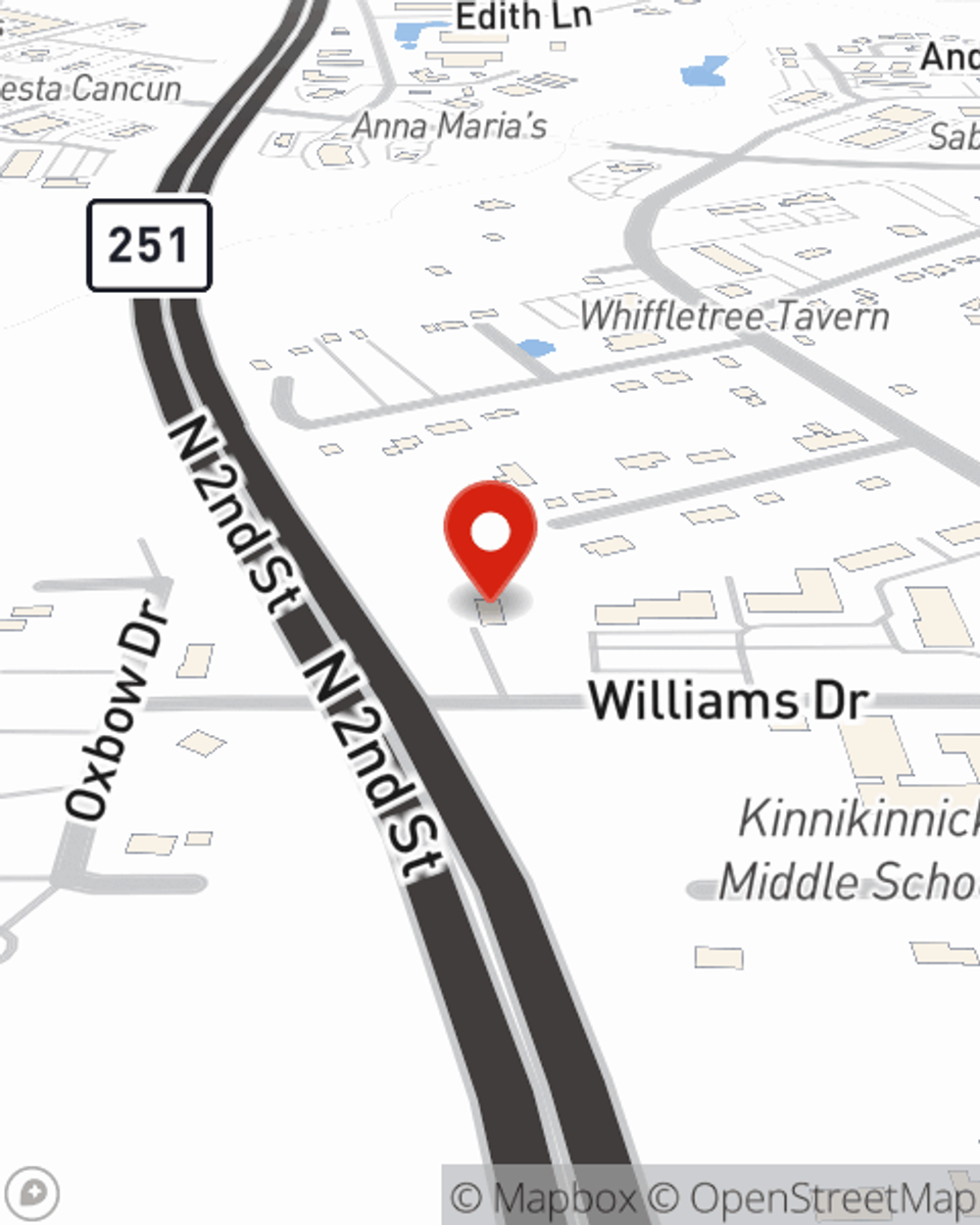

As a commited provider of condo unitowners insurance in Roscoe, IL, State Farm helps you keep your belongings protected. Call State Farm agent Erik Abrahamsen today for a free quote on a condo unitowners policy.

Have More Questions About Condo Unitowners Insurance?

Call Erik at (815) 397-7600 or visit our FAQ page.

Simple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.

Erik Abrahamsen

State Farm® Insurance AgentSimple Insights®

House hunting

House hunting

House hunting can be a time-consuming process, but with some research and foresight, you may be able to avoid wasted time and expensive risks.

Help control your home monitoring system with your smartphone

Help control your home monitoring system with your smartphone

The latest generation of smart home monitoring goes far beyond smoke detection and intrusion alerts.